Budgeting with Moneysoft

Creating a budget yourself can be difficult so Moneysoft has made the process easy by automatically collecting all your financial account transactions, no matter where they are held and categorising your income and expenses into different buckets. The process of budgeting still needs a little help from you though, so here are some handy hints to get you on the right track.

Click here to download the PDF version.

1. Before You Get Started

Before you start creating your budget, it will help to consider it as a promise. A promise you are making to yourself to improve your cash flow position and reduce your debt. By tracking, measuring and sticking to your budget you can fulfill that promise and get started on the road to a better financial life.

To help breakdown your budget into simple to achieve components, set yourself a goal. That goal can be anything but make sure it’s realistic, achievable and you understand how you’ll measure your own progress. “Spend less that I earn every month”, “Pay $500 off my credit card every month for 12 months”, “Make $250 additional repayments to the home loan for two years”, or “Save $200 every week until I retire”.

2. Getting Started

People can be afraid to look at their spending because they may feel guilty from the feeling they are “doing something wrong”. While this is understandable it is important to defeat this fear and focus on the positive steps towards making a positive difference.

Now that you are ready to start Moneysoft is here to help you through the process. After you’ve registered for your Moneysoft account, start creating a budget by following these handy tutorials. You may be surprised by what your budget figures initially show but don’t worry, Moneysoft has everything you need to make the planning and tracking easy.

3. Budget Tips

|

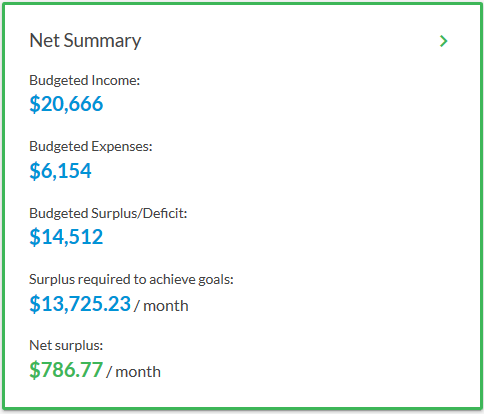

Once you have gone through the tutorials and created your first budget, it is time to make that promise to yourself. The automatically calculated budget is a view of where you are now. How you have been spending. The old way. It is now time to start on the path to the new way. With your goal in mind, it is time to decide what changes you will make in order to achieve it. Moneysoft includes a Goals feature that will automatically calculate how much you can continue to spend in order to meet your desired goal/s. Set your goals/s then edit your budgeted expenses until the “Net Surplus” number in the Net Summary tile is positive. This is a very handy tool that helps you quickly understand your budget position both before and after goals savings are accounted for. |

|

3.1. Income

|

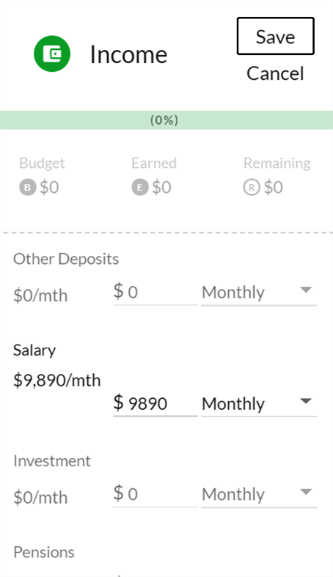

First, confirm all of your budgeted income is correct:

|

|

3.2. Expenses

Now it’s time to adjust and refine your budgeted expenses to reduce these to allow you to meet a budget surplus and meet your goal contributions. Remember, your budget is a promise that provides a roadmap to achieve the goal/s you have set for yourself. We understand that your budget is not set in stone and may require adjustment along the way, but it is a vital tool to review and benchmark your actual income and expenses against your plan. If you can measure it, you can manage it. As a general tip, consider all expenses as either Fixed (can’t be easily changed, e.g. Rent) or Variable (can be easily changed, e.g. Entertainment or changed with a bit of effort, e.g. Utility Bills).

3.2.1. Fixed Expenses

Home, Living and Mortgage Expenses

For many this is the biggest (and most important) expense in the budget, so it needs to be completely covered:

- Confirm Mortgage repayments (in the Repayments group) and Rent (in the Living group)

- Budget an amount for other fixed expenses

Other Fixed Expenses

Confirm all other fixed expenses are included and accurate by reviewing the transactions under Repayments, Fees and Transport categories. Are all these expense amounts still relevant? Can any be removed from your budget going forward?

- Repayments – This includes any Personal Loan (car) and Investment Loan repayments.

- Fees – This includes Bank Fees, Education Costs and Rental Property Expenses.

- Transport – This includes Vehicle, Fuel, Parking and Public Transport costs. Is it possible to use more public transport and less private transport to reduce expenses?

3.2.2. Variable Expenses

Living Expenses

Some expenses will be more negotiable (e.g. Clothing, General Merchandise) than other expenses (e.g. Health Care and Medical, Food and Groceries).

| Tip |

|

If you need help with how much you should be budgeting for these expenses ask your Adviser for a copy of a Budget vs Actual Benchmark Report. This will show you what percentage of income people in a similar family situation spend in each of those categories. |

Lifestyle Expenses

Now that all Fixed and Living expenses have been budgeted for, the final step is to make the trade-off between your desired lifestyle expenses and your savings goals. For many people, this is where some of the biggest changes can be made as it is simply a decision between spending today and saving for tomorrow.

While your goal may be to maximise savings it is important to be realistic and still budget for some activities that give you happiness and enjoyment.

- Entertainment – This includes Entertainment (e.g. Concerts, Movies etc.), Pay TV Subscriptions, Restaurants and Travel.

- General – All other expenses that are completely discretionary.

4. Tracking Your Budget

| You have now set your budget and the promise has been made.To protect your budget from unintended changes make sure you set it to Locked. |  |

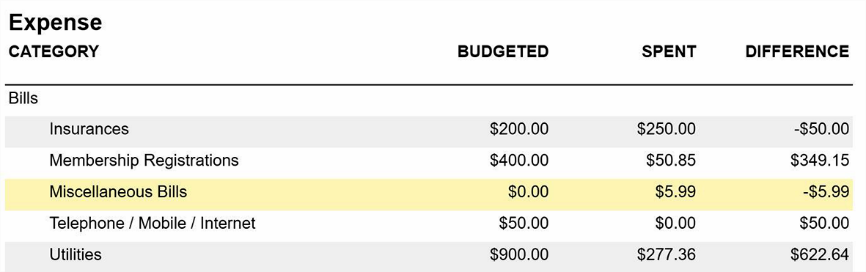

| Moneysoft has several tools to help you track your budget progress with one of the more useful being the Budget vs Actual Report available from the Dashboard page. |  |

This report shows exactly how much you have actually earnt and spent compared to your predicted, budgeted income and expenses over any time period. Importantly it shows the categories where you’ve performed better than expected and those which may still need some work (but if you’re keeping the promise to yourself, you’ll probably know those already!)