The Latest

Experience the latest news from Moneysoft here.

Posted 9 months ago by Moneysoft Sales 1 Minute(s) to read

RELEASE NOTES: Moneysoft PFM –Q4 Oct -Dec 2024 & Q1 Jan-Mar 2025

The following release notes detail the updates and new features for Moneysoft PFM as of the latest versions: Application Version: 3. 0. 21. 20250331 SDK Version: 2. 0.

Read more

Posted 13 months ago by Moneysoft Sales 3 Minute(s) to read

RELEASE NOTES: Moneysoft PFM –Q2 April-June 2024 & Q3 July-Sept 2024

The following release notes detail the updates and new features for Moneysoft PFM as of the latest versions: Application Version: 3. 0. 21. 20241105 SDK Version: 2. 0.

Read more

Posted 21 months ago by Moneysoft Sales 4 Minute(s) to read

RELEASE NOTES: Moneysoft PFM – November/December 2023 & Q1 January-March 2024

The following release notes detail the updates and new features for Moneysoft PFM as of the latest versions: Application Version: 3. 0. 20. 20240405 SDK Version: 2. 0.

Read more

Posted 2 years ago by Moneysoft Sales 2 Minute(s) to read

RELEASE NOTES: Moneysoft PFM – September and October 2023

The following release notes relate to: Application Version: 3. 0. 20. 20231020 SDK Version: 2. 0.

Read more

Posted 2 years ago by Moneysoft Sales Less than a minute to read

Upcoming Webinar with Moneysoft CEO and Open Banking Partner Yodlee

Register Here Date: Wednesday, September 27, 2023 Time: 5pm AEST / 8am BST Expanding your business and your customer base may require leveraging consumer-permissioned financial data in other regions.

Read more

Posted 2 years ago by Moneysoft Sales 2 Minute(s) to read

RELEASE NOTES: Moneysoft PFM August 2023

The following release notes relate to: Application Version: 3. 0. 20. 20230828 SDK Version: 2. 0.

Read more

Posted 2 years ago by Moneysoft Sales 4 Minute(s) to read

Moneysoft delivers open banking win for financial advisers

Media Release – August 2023 Moneysoft delivers open banking win for financial advisers and superannuation funds, powered by Envestnet | Yodlee Sydney, Thursday 24 August, 2023 In a win for the financial advice...

Read more

Posted 2 years ago by Moneysoft Sales Less than a minute to read

Standing apart with distinctive services and an outcome focus

Last year Moneysoft CEO Jon Shaw wrote an article for Ensombl– ‘Is engagement a reliable proxy for success’ – which examined the ways Advisers could create sustainable differentiation.

Read more

Posted 2 years ago by Moneysoft Sales 3 Minute(s) to read

RELEASE NOTES: Moneysoft PFM June – July 2023

The following release notes relate to:

Application Version: 3.0.20.20230724

SDK Version: 3.0.20 20230724

Read moreMost Popular

You can view some of our most popular news articles below.

Posted 7 years ago by Moneysoft Sales 2 Minute(s) to read

Media Release: New website launches with solutions to support Super funds

MEDIA RELEASE Moneysoft launches new website to support super fund focus December 14, 2018 Financial technology company Moneysoft has launched a new website that showcases its growing range of services to large...

Read more

Posted 7 years ago by Moneysoft 4 Minute(s) to read

Research shows that budgeting and cashflow management the top advice priority for younger Australians

Research shows that budgeting and cashflow management the top advice priority for younger Australians 15 January, 2019 Younger people overwhelmingly rank budgeting and cashflow management as the most valuable type of...

Read more

Posted 9 years ago 2 Minute(s) to read

Moneysoft enters new partnership with Mortgage Choice

April 11th, 2017: Moneysoft’s advice technology will power a new Mortgage Choice Financial Planning tool aimed at bolstering clients’ money management skills and helping them reach their financial goals.

Read more

Posted 8 years ago 2 Minute(s) to read

Moneysoft and IRESS XPLAN deliver a powerful combination

Curbing regulatory changeMaintaining and adhering to the regulatory compliance standards in Australia, means that Financial advisers face new challenges to deliver a quality service offering.

Read more

Posted 7 years ago Less than a minute to read

Bringing tailored advice to the mass market using technology

Adele Martin, Money Mentor. Adele Martin, is transforming the advice industry, using technology to scale her business.

Read more

Posted 7 years ago 1 Minute(s) to read

Innovative benchmarking for advisers and clients

As part of the standard offering, Moneysoft includes free access to a benchmarking and reporting tool giving Advisers unique insights into the spending habits of their clients and the ability...

Read more

Posted 7 years ago Less than a minute to read

How to help young professionals reach their goals

Michael Chew, Co-Founder & Director of Orange Wealth Michael's clients are typically young, professional families.

Read more

Posted 7 years ago 2 Minute(s) to read

New budget overview

Overview The budget page has undergone a significant re-design. Check out our walk through video by clicking here.

Read more

Posted 7 years ago 2 Minute(s) to read

Release notes August / September 2018

The process of entering in updated credit card details has been improved to prevent an issue where this could fail and not provide an error message.

Read moreAll Posts

Take a look through our posts! There's a wealth of useful information for you and your business.

Posted 6 years ago by Moneysoft Sales Less than a minute to read

Release Notes April 2020

1. Calendar PPF DownloadAn issue that was preventing the calendar from downloading as a pdf has been resolved. 2.

Read more

Posted 6 years ago by Moneysoft Sales Less than a minute to read

Release Notes March 2020

1. Expired GoalsGoals which had reached their end date, but not achieved their target value were still being displayed in the Active Goals list.

Read more

Posted 6 years ago by Moneysoft Sales 3 Minute(s) to read

Release Notes December 2019 / January 2020

1.

Read more

Posted 6 years ago by Moneysoft Sales 1 Minute(s) to read

Release Notes November 2019

1. New Property ModuleThe Property function has been completely rebuilt. Previously there were two options to link a property – Manual Value or Estimated Value.

Read more

Posted 6 years ago by Moneysoft Sales Less than a minute to read

SuperCents named Finalist for Best New Innovation at SuperRatings Awards.

Intrust Super was shortlisted as a Finalist for the SuperRatings Best New Innovation award at the 2019 Lonsec Fund of the Year awards dinner in Sydney on Wednesday night for...

Read more

Posted 6 years ago by Moneysoft Sales 3 Minute(s) to read

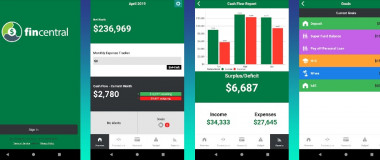

Media Release: IOOF partner with Moneysoft to launch fincentral cash flow budgeting app

MEDIA RELEASE IOOF launches fincentral cash flow budgeting app October 9, 2019 Leading wealth management company IOOF has launched an online budgeting app to assist hundreds of thousands of Australians trying to become...

Read more

Posted 6 years ago by Moneysoft Sales 2 Minute(s) to read

Release Notes September 2019

1. Deleted Calendar EventsAn enhancement was made to improve the way the Calendar handles deleted future events. 2.

Read more